Living hand to mouth is not bad, contrarily, cannot consider it feeling financially secure as well. It is not that we are all born with a silver spoon, everyone slogs all day to earn and save. If you look around the globe, most of us live paycheck to paycheck. Is this all? Do you think you have to live paycheck to paycheck, well, the good news is you have a way out to stop living pay check to paycheck.

Looking at this practically, everyone would have different financial problems, for a few it could be because of debts that they can barely make ends meet, for few it could be loaded responsibility of earning for home or few people must be under-payed. Whatsoever, if there are workable ways to set this right then why not just try and implement to see if it is going to work well.

This article aims at teaching you some of the easy ways that you can practice to stop living paycheck to paycheck. You deserve to sleep stress free and live a better life if the tips work a way for you. You have it all you need to know about living in peace and comfortably.

[ Also Read: Are You Unemployed And Wondering How To Save Every Cent? ]

Why Should You Stop Living Paycheck To Pay Check?

Here are the reasons why you should stop living paycheck to paycheck. Take a look at them! These are the Main Complexions we have to taken into consideration

- Sleep peacefully

- To avoid unnecessary mental stress

- Get smart in managing your finances

- For leading a better lifestyle

- To have the satisfaction for what you have

- Have to understand strategies on how you can earn better

Having an understanding of why is it important to stop living paycheck to paycheck you would be able to relate with how to get serious and start working on it immediately.

Practical Tips On How To Stop Living Pay Check To Pay Check – Be Wise!

Living stringent would go away for the time being. However, if you have to manage this way for a long time, would you be able to compensate or scrap through? Think about it! Do not put yourself in such a fix, when you have ways to deal with your problem and improve your situation, why not work over it? Here are tips on how to stop living paycheck to paycheck. Take a look!

Living stringent would go away for the time being. However, if you have to manage this way for a long time, would you be able to compensate or scrap through? Think about it! Do not put yourself in such a fix, when you have ways to deal with your problem and improve your situation, why not work over it? Here are tips on how to stop living paycheck to paycheck. Take a look!

Basic Tip 1 – See The Real Picture!

“The secret of getting ahead is getting started” – Mark Twain

Only when you stop by and keep a watch over what you have vs how you spend you will clearly be able to determine or get a clarity as to what needs to be changed immediately in how you are handling your finances.

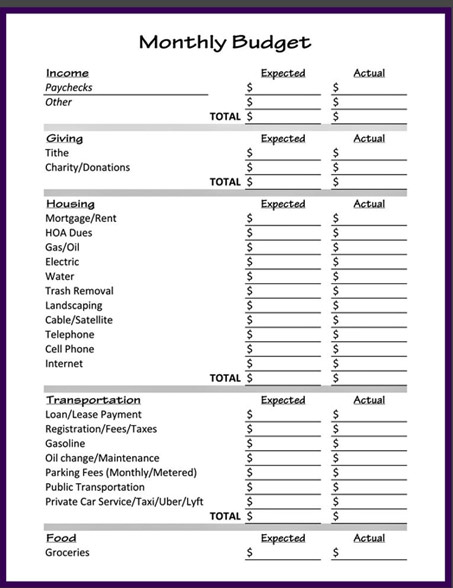

Make a comparison sheet, in the ration of 1 : 3. 1 implies how much you get in hand and the other part would further be divided in three, 1 would be your major expenses at home such as bills, groceries, maintenance,loans, rent, etc. 2 would be the money you use for entertainment. 3 would be your miscellaneous expenses.

This is a basic tip to begin with, get the real picture and get going with what you have to do next. This is more or less like keeping a track of all your expenses. This tip would make it easier for you to figure out how to stop living paycheck to paycheck.

Serious Tip 2 – Eliminate Excessive Spending

[embedyt] https://www.youtube.com/watch?v=CUnSDYIR1CE[/embedyt]

A small leak can sink a ship!

If you can be smart and cut down on unnecessary expenses you could be saving yourself from not losing out on a lot from what you earn. That said, you can cut down on your entertainment expenses that is not going to be of use to you as much as a considerable amount of saving would be.

[ Related: Ways To Save Money on Wardrobe Like Never Before ]

Look back at the sheet you made where you tracked down all your expenses, look at the column where you have tracked the expenses incurred on entertainment, from that list see what is really necessary to you, do not compromise on it, eliminate an expense that is easy to forgo.

For instance, if you spend money on buying two cigarettes everyday you could limit yourself to smoking thrice a week only.

Smart Tip 3 – Saving Will Help You Feel Secure

“Money looks better in the bank than on your feet”- Sophia Amuroso

The more you save the better for you to feel financially secure as well as have a reserve for the future.

While not everyone is convinced with the idea of saving, it is always necessary because you never know when would emergency knock at your door or looking at the positive side, you never know when would you need it do either study or invest it.

When you cut down on expenses that is in your access, it gets easier to start saving. You can begin with saving a minimal amount and further increase your saving. You can start. Here are some of the interesting ways to save money. Take a look at them!

- Save all your reward points and keep it aside for future use

- If you want to buy a gift for someone prefer making it on your own

- Do not exceed your limit on shopping. Be strict

- Shop in stores when there is a sale or discount offer

- Do not go too much too restaurants, save that money for your home

- Observe the little things you can do at home to save money

Final word : Make room for saving at-least 10 percent of your income. When you learn how to save even when you come into a paycheck to paycheck situation you will manage to get through it. In the first place saving will never put you in a tight position.

Great Tip 4 : Fix Your Budget And Your Issues Will Get Fixed

When you fix your mind to having a good budget it makes your work easier. Have a clear budget set and all your finance troubles will be solved. Here are interesting ways to prepare a good budget.

[ Related: Money Management Tips for a secure future ]

- Make your budget plan colorful and fun

- Do not take it too much into your head, stay cool and make it

- Have a schedule for how many months in a year are you going to stick to the budget

- Plan your budget well, take help from a budget app if you think it is essential

- Be strict with following your budget

- If you begin to earn better you can go ahead and makes changes to your budget

Final word : Make a good budget and see how your life would change and you will not need to live from paycheck to paycheck.

Sensible Tip 5 – Follow A New Way Of Saving

There is another way of saving where you can secure every penny that is left over at home after you have paid off all the expenses.

Having said, make saving plans wherein you can let a small part of your amount go into your retirement plan. Best way of doing it is putting your money in 4O1K savings or you could have a recurring deposit account, the money would directly go into your account without you having to be alert on what you are spending.

[ Also Read: Complete Beginner’s Guide to Save Money ]

Yes! Automatic transfers are a good way to keep your money intact, even if you are living paycheck to paycheck, at the back of your mind you would feel safe that you have some amount saved.

Strict Tip 6 – Be Stringent With How You Save Money

It is human psychology that we tend to take our savings for granted and want to spend it up when we feel broke. We start to think that it is okay to use money from savings.

If you go about with this thought process then you would have to live paycheck to paycheck forever. If you do not want that, you are supposed to put your money in such a savings plan where you cannot remove it for a fixed period. This way you would not circum to temptation and spend your savings.

[ Also Read: Tips For Joining Work Post Career Break ]

Great Tip 7 – Compensate Expenses That Are Costing You A Bomb

You should get awareness about how much should you ideally be spending for expenses at home.

Say suppose you notice that you are spending more than required for your rent or for the car maintenance , then re-consider and see what best you can do to accommodate that expense.

[ Also Read: How to Kick Overspending And Reasons Why You Overspend Money ]

Try and stay in a place that is less expensive or replace your car that does not need too much of maintenance. You are not necessarily depriving yourself of the comfort but you are just being sensible in your spending pattern.

Valuable Tip 8 – A lump-sum Can Go Into Saving

Do not have second thoughts on how to use lump sum amount you receive. You would get the bonus amount or probably incentives for your performance. Isn’t it? Why not save most of it than blowing it up. You can blow it up partially because it is not nice to suppress yourself too much either.

[ Also Read: Stop the Financial Lies Every Woman tells to themselves ]

That said, put the lump sum amount into a savings account, it will make you feel good that you invested your money the right way.

Right Tip 9 – Look For The Right Guide

When you have someone motivating you all the time and giving you the right advise, you are going to do well in saving money and being on track. You never know this could work a way for you.

You can either take guidance from someone you can rely on or an expert or adviser who has the required knowledge to make you walk the right path.

[ Also Read: How To Plan A Budget With Live-In Partner ]

Useful Tip 10 – Sell What You Don’t Use

What is not useful to you might be useful to someone else. This means, instead of discarding things that are not in use or you feel its not worth keeping it is better to sell them away to someone who needs it the most.

Again, how much will you get out of what you sell depends on its value. The money that you get after sale could either be invested into something that helps you make profits or you could save it and use that money when you need it the most. This would be a great way of collecting money.

Useful Tip 11 – Appreciate Yourself For Doing A Great Job

If saving was as tough as finding life in another planet then you have done a great job. You should appreciate yourself for being able to do something that you are never used to, given your lifestyle until now.

[ Also Read: How To Be A Successful Woman At Your Workplace – If You Can Dream It, You Can Do It! ]

Besides appreciating yourself you need to be a little more patient by continuing to do the same so that you do not have to struggle living paycheck to pay check. It is easy to lose control and go back to the old track, it takes courage to remain on the tough path and remain glued to saving money and being sensible with spending.

Smart Tip 12 – Say Adieus To Debt

Primarily, you should first focus on clearing off all the debts you have, once this stress is out of your mind you will have the burden off your back. When you are free from burden, the other things start to fall in place.

If your debt amount is minimal then you need not worry too much, the first thing you should do is to pay it off and focus on how to save and invest money where thew risk to lose is not too much. If the debt amount is too much then plan to pay it off in such a way that you are reducing a little of your burden everyday.

All in all, once you are through paying all your debts, do not ever get yourself in a similar situation again. Adjust with the little you have but at any cost do not loans or apply for any credit cards, get all your credit card accounts closed.

Essential Tip 13 – Work Hard To Strengthen Your Bank Balance

If you have to improve you present financial situation you need to work harder and look at ways to earn better. There is no doubt in the fact that you would need to work on your debts first. Apart from this you need to be sure if what you are earning is enough or not.

None of us are satisfied with what we earn because our needs end up being more than what we earn. It is a similar situation with most of us.

[ Also Read: Work Hard at 20s,To Live Regretful Life On Your 40s ]

In order to be able to make good money you need to take steps in doing more than what you are presently doing. That said, see how to get promoted or look for a better opportunity that pays you better.

Another useful idea is to do a freelance during the weekend or take up part time projects. This way your problem of not having enough to meet your needs would be solved.

To put it all together, you should stop living paycheck to paycheck kind of a lifestyle because it would make you unhappy and disrupt your mental peace.

What you should possibly do is save money, cut on your extravagant expenses, not just save money but adopt tips to save smartly, try and use less expensive stuff, adjust your standard of living, pay off all your debts, use lump sum amount the right way, sell things that you do not need.

Conclusion

Yes, it might seem too restricted if you are used to spending well and you have to stop it all of a sudden. However, at some point if you want to stop living paycheck to paycheck it comes with a cost of sacrificing for a while. In that course of time you would become an expert and learn how to manage all your finances.

Today if you are disappointed with the fact that you are living paycheck to paycheck. Then you do not have to be upset because there are several ways to manage during financial crisis. Invest all your efforts in finding ways to earn better.

Make Your Passion Your Paycheck!